Stock Market

CTEEP preferred and common stock (TRPL3 and TRPL4) is listed on the São Paulo Stock Exchange (BM&FBovespa). The preferred stock (TRPL4) is a component of the Ibovespa Stock Index, the most important indicator of average quote performance of share prices in the Brazilian stock market quotation, and the IGC (Corporate Governance Index), a theoretical portfolio comprised of stock of companies with high levels of relationships with all their stockholders and other stakeholders.

In 2010, the common stock (TRPL3) and preferred stock (TRPL4) had an appreciation in value of 13.15% and 6.47%, respectively, compared to 2009, ending the year quoted at R$ 61.10 (common) and R$ 55.10 (preferred). In the same period, Ibovespa presented an appreciation in value of 1.04%, and the Electricity Index (IEE) of 11.98%.

CTEEP common stock (TRPL4) had an average daily trading volume at BM&FBovespa of R$ 7.2 million, with a daily average of 690 transactions. The total trading volume in the year was R$ 1.8 billion.

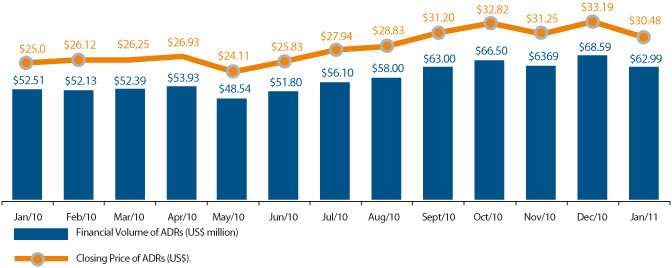

CTEEP also has a program sponsored by the American Depositary Receipts (ADR) Level 1, based on common and preferred stock at the rate of a Depositary Share for each share of both classes. At the end of 2010, the stock base of the Company was comprised of 23,699 ADRs regarding the common stock and 2,066,718 ADRs regarding the preferred stock. In the same period, the ADRs based on the common stock presented an appreciation in value of 33.66%, and the ADRs based on preferred stock, of 11.79%.

Stockholders´ Remuneration

In view of the net earnings recorded in 2010, of R$ 812,171 million, including dividends paid in January 2011, CTEEP stockholders received R$ 573,6 million as proceeds corresponding to R$ 3.78 per share of both classes. Considering the proceeds distributed over the year, the total return to the stockholder was 25.04% for holders of common stock and 18.10% for holders of preferred stock.