In 2016, ISA CTEEP recognized the value of the updated RBSE, with an impact of R$ 7,318.5 million in financial assets, R$ 6,503.6 million in net operating revenues, R$ 2,211.2 million in deferred income tax and social contribution provisions, and R$ 4,292.4 million in net income.

The measurement and accounting of the right referring to installations of the Power Grid was possible after publication of Technical Note 336/2016 by the National Electric Energy Agency (ANEEL) in October 2016, which resulted in the opening of Public Hearing 68/2016, for the period from October 14 to November 14, 2016, in order to obtain subsidies and additional information for the improvement of calculating the cost of capital to be added to the RAP of transmission concessionaires, covered by Law No. 12.783/2013, pursuant to MME Ordinance 120/2016.

2016 Results - IFRS

In 2016, the Gross Operating Revenue for ISA CTEEP Consolidated reached R$ 8,774.3 million, due substantially to the updating of the financial asset of accounts receivable from the RBSE, amounting to R$ 7,318.5 million.

The consolidated Infrastructure Revenue totaled R$ 171.9 million in 2016, a decrease of 38.3%, when compared to R$ 278.7 million in 2015. This performance is primarily due to the completion of reinforcement projects, implementation of new infrastructure installations at substations, and recapacitation of transmission lines at the parent company.

At the subsidiaries, there was a decrease in revenue from infrastructure due to the closure in 2015 of the implementation phase of the facilities for the transformer bank, capacitors and reactors at IEPinheiros and Serra do Japi.

Revenue from Operations and Maintenance Services – In 2016, the consolidated Revenue from Operation and Maintenance added up to R$ 835.8 million, a 0.8% increased vs. R$ 829.6 million in 2015. This increase is explained mainly by the positive change of the IGPM/IPCA price indices applied to the portion of O&M revenues, which correct the RAP of the 2015/2016 cycle for the 2016/2017 cycle, reduction of entry of new projects, and negative variation of the portion of adjustment (PA).

Consolidated Revenue from Remuneration of Concession Assets totaled R$ 7,743.2 million in 2016, reflecting the updating of the amount of accounts receivable from the RBSE, which resulted in an adjustment to the asset of R$ 7,318.5 million. Excluding this effect, the Revenue from Remuneration of Concession Assets totaled R$ 424.7 million in 2016, an increase of 36.3% compared to 2015, reflecting primarily the adjustment of the RAP 2016/2017 cycle and updating of the financial asset.

Other Revenues relate to leases with telecommunications companies and provision of services related to maintenance and technical analysis engaged by third parties. In 2016, these revenues totaled R$ 23.4 million, a 5.4% increase compared to 2015. Deductions from Operating Revenue (consolidated) totaled R$ 985.1 million in 2016, compared to R$ 154.9 million in 2015, bringing the effect of the PIS/COFINS provision in the amount of R$ 814.9 million on the remuneration of the RBSE concession asset.

Net Operating Revenue in 2016 reached R$ 7,789.2 million, mainly due to the recognition of remuneration of the RBSE concession assets in the amount of R$ 6,503.6 million.

O&M costs and expenses in 2016 were R$ 479.5 million, a reduction of 8.2% compared to 2015. This reduction of costs and expenses brings mainly the effects of the increase in costs and expenses on personnel due to the collective bargaining agreement of 9.32% granted in 2016; the increase in the material due to the consumption of inventory applied in the maintenance of transmission lines and substations; the increase in third party services due to the maintenance and conservation of transmission lines and substations and contractual adjustments; and reduction in contingency expenses due to the non-recurring effect of the revision of the methodology in labor lawsuits, in 2015, when ISA CTEEP started considering historical convictions with available evidence, and similar cases.

The consolidated infrastructure costs recorded R$156.4 million in 2016, a decrease of 38.6% compared to 2015. This change follows the downturn in infrastructure revenue, stemming from the completion of reinforcements projects and reduced activity of infrastructure implementation.

The result of equity accounting (consolidated) in 2016 recorded revenue of R$ 267.7 million, an increase of 66.0% compared to revenue of R$ 161.3 million recorded in 2015. The positive change stems mainly from the increase in net sales of the subsidiaries IEMadeira and IE Garanhuns, reflecting the adjustment of the 2016/2017 RAP cycle of both, and receipt of the full RAP in IEGaranhuns for the entry into commercial operations in late 2015.

The consolidated financial result recorded an expense of R$ 109.9 million in 2016, an increase of 333.5% compared to expense of R$ 25.3 million recorded in 2015. The variation mainly reflects the end of the revenue from monetary variation and interest revenue, referring to the updating of the IPCA price index + 5.59%, receipt of accounts receivable of assets reversible by Law No. 12.783 (RBNI), combined with the increase in costs of monetary variation by the correction for inflation for lawsuit provisions.

The Income and Social Contribution Tax Results presented an expense of R$ 2,333.9 million, due to the establishment of deferred Income Tax/Social Contribution provisions in the amount of R$ 2,211.2 million due to the effect of the recognition of remuneration from the RBSE concession asset in P/L for 2016. Excluding the effect, consolidated Income Tax and Social Contribution resulted in an expense of R$ 122.7 million in the year, 32.8% higher than in 2015.

Net Profit in 2016 totaled R$ 4,949.3 million, compared to R$ 517.2 million in 2015, due to the impact of R$ 4,292.4 million of the recognition of the remuneration from the RBSE concession asset. Excluding this effect, net profit was R$ 656.9 million in 2016, an increase of 27.0%.

Consolidated EBITDA, according to ICVM 527/12, was R$ 7,404.8 million. Excluding the effect of the recognition of the remuneration from the RBSE concession asset, EBITDA was R$ 901.1 million in 2016, an increase of R$ 225.3 million compared to EBITDA of R$ 675.8 million recorded in 2015.

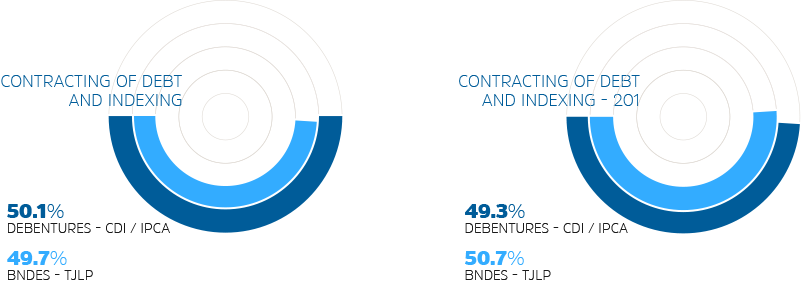

Capital Structure

DEBT*

Consolidated gross debt on December 31, 2016 totaled R$ 1,010.5 million, a decrease of 7.9% compared to the end of 2015, when it recorded R$ 1,096.7 million, mainly reflecting the payment of R$ 270.2 million in principal and interest of the debentures of the Company’s 1st and 3rd issuances and issuance in August 2016 of R$ 148.3 million in infrastructure debentures.

Cash and cash equivalents of consolidated ISA CTEEP totaled R$340.6 million on December 31, 2016, a reduction of 23.7% compared to that recorded on December 31, 2015. Consolidated net debt totaled R$ 669.8 million, an increase of 3.0% compared to the net debt at year-end 2015.

Investments

In 2016, ISA CTEEP, its subsidiaries and jointly controlled companies invested a total of R$ 191.8 million in reinforcements, new connections and refurbishments, compared to R$ 376.5 million invested in 2015. The variation is mainly due to the efforts of trade negotiations to reduce contractual prices, and projects suspended in order for ISA CTEEP to seek better financial return.

At a meeting held in December 2016, the Board of Directors approved the Investment Plan for 2017 of up to R$513.8 million, as follows:

- R$ 310.3 million for reinforcements, new connections, modernization, and improvements in ISA CTEEP, generating additional revenue to the Company by energizing each investment project;

- R$ 157.6 million in investments by subsidiaries for completion of the works of the original project of IEMadeira and IEGaranhuns, initial expenses of IEItaúnas, IE-Aimorés and IEParaguaçu, as well as reinforcements and improvements at the other subsidiaries;

- R$ 45.9 million in capitalization of personnel and corporate.

The postponement of investments in IEMadeira is conditional upon completion of integrated tests, slated for the first half of 2017.

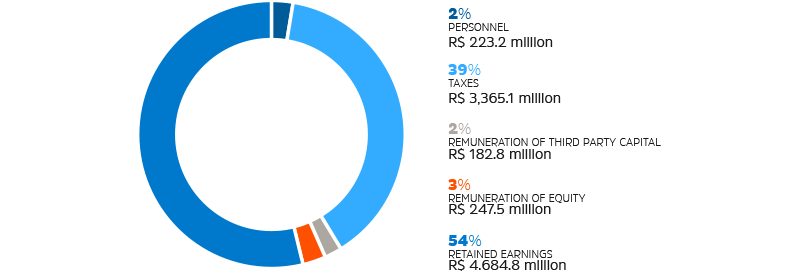

Statement of added value (DVA)

G4-EC1

CTEEP demonstrates transparently the wealth generated each year, returning to and sharing its achievements with the society In 2016, the net added value available to the Company totaled R$8,703.4 million. Such funds were allocated as follows:

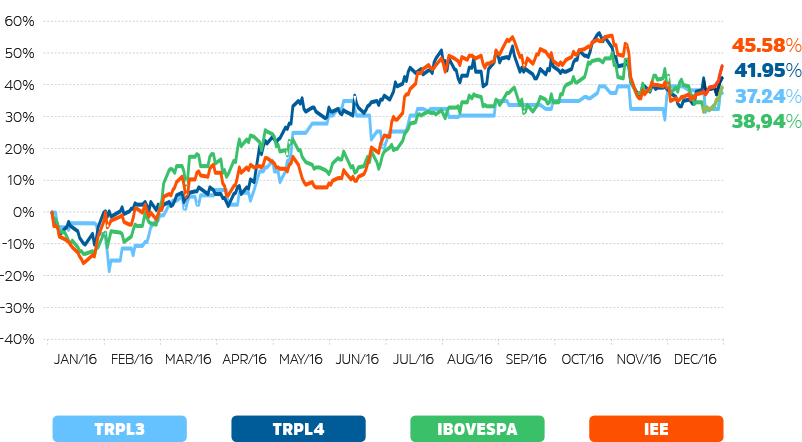

Capital market

In line with the market’s strong performance in 2016, ISA CTEEP’s common and preferred shares (Bovespa: TRPL3 and TRPL4) closed out the year at R$ 59.00 and R$ 64.87, with variations of 37.24% and 41.95%, respectively, compared to December 31, 2015.

In the same period, Ibovespa index (an index that includes the more liquid shares on the BM&F Bovespa), presented an appreciation of 38.94% and the IEE (Electric Power Index) that accumulated an increase of 45.58%.

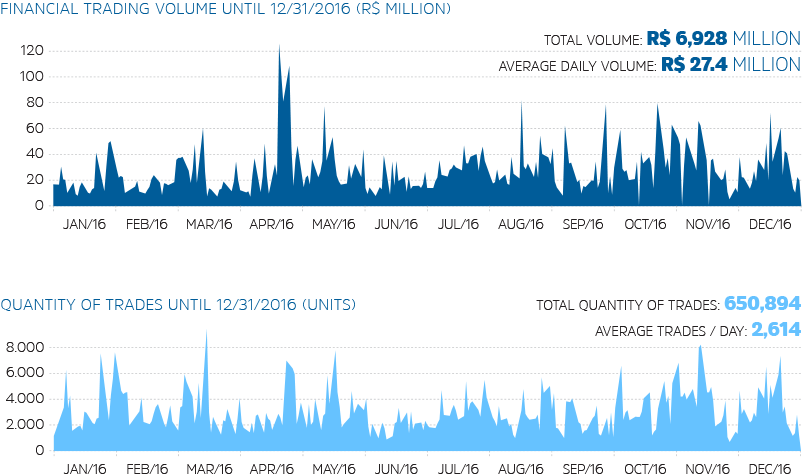

Throughout 2016, the preferred shares of ISA CTEEP presented an average daily trading volume on the BM&-FBovespa of R$27.4 million, an increase of 83.9% compared to 2015. The total TRPL4 trading volume for the year was R$6,928 million.

With a daily average of 2,614 trades, an increase of 37.0% compared to the average of 2015, ISA CTEEP’s preferred shares reached 650,900 trades in 2016, an increase of 38.5% compared to 2015 (470,000 trades).

CAPITAL INCREASE

G4-13

As a result of the capital increase in 2016, the total number of preferred shares (TRPL 4), which are held by domestic investors (79%) and foreign investors (21%), increased from 96,775,022 shares to 100,236,393 shares. Consequently, the percentages of the stakes of the shareholders changed, as shown below:

| Shareholder | Number of shares | % of the total |

|---|---|---|

| ISA Capital of Brazil |

59,222,140

|

35.95

|

| Eletrobras |

58,295,419

|

35.39

|

| Vinci Participações |

5,528,251

|

3.36

|

| Other |

41,675,016

|

25.30

|

| TOTAL |

164,720,826

|

100

|