Stock Market

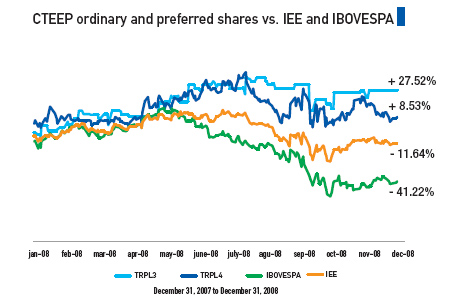

As a result of the global financial crisis which was felt in 2008, the IBOVESPA (index that measures the return on a portfolio consisting of the shares that make up 80% of the volume traded on the São Paulo Stock Exchange) fell by 41.22%, and the Electrical Energy Index (IEE) by 11.64%. CTEEP papers went in the opposite direction: ordinary shares (TRPL3) rose 27.52%, and preferred shares (TRPL4), 8.53%, closing the year at R$ 45.09 and R$ 42.00, respectively.

During the year, CTEEP preferred shares were involved in 160,858 trades on the BOVESPA, representing an increase of 57.2% in relation to 2007, and making CTEEP one of the seven companies with the best share performance in 2008. The financial volume traded was R$ 3.16 billion, up 45.32% on 2007.

CTEEP also participates in Level 1 of the American Depositary Receipts (ADR) program, linked to ordinary and preferred shares. The depository institution in the United States is the Bank of New York Mellow. In Brazil, Itaú S.A. is the custodian institution for the shares linked to the ADRs (one Depositary Share per share of both classes).